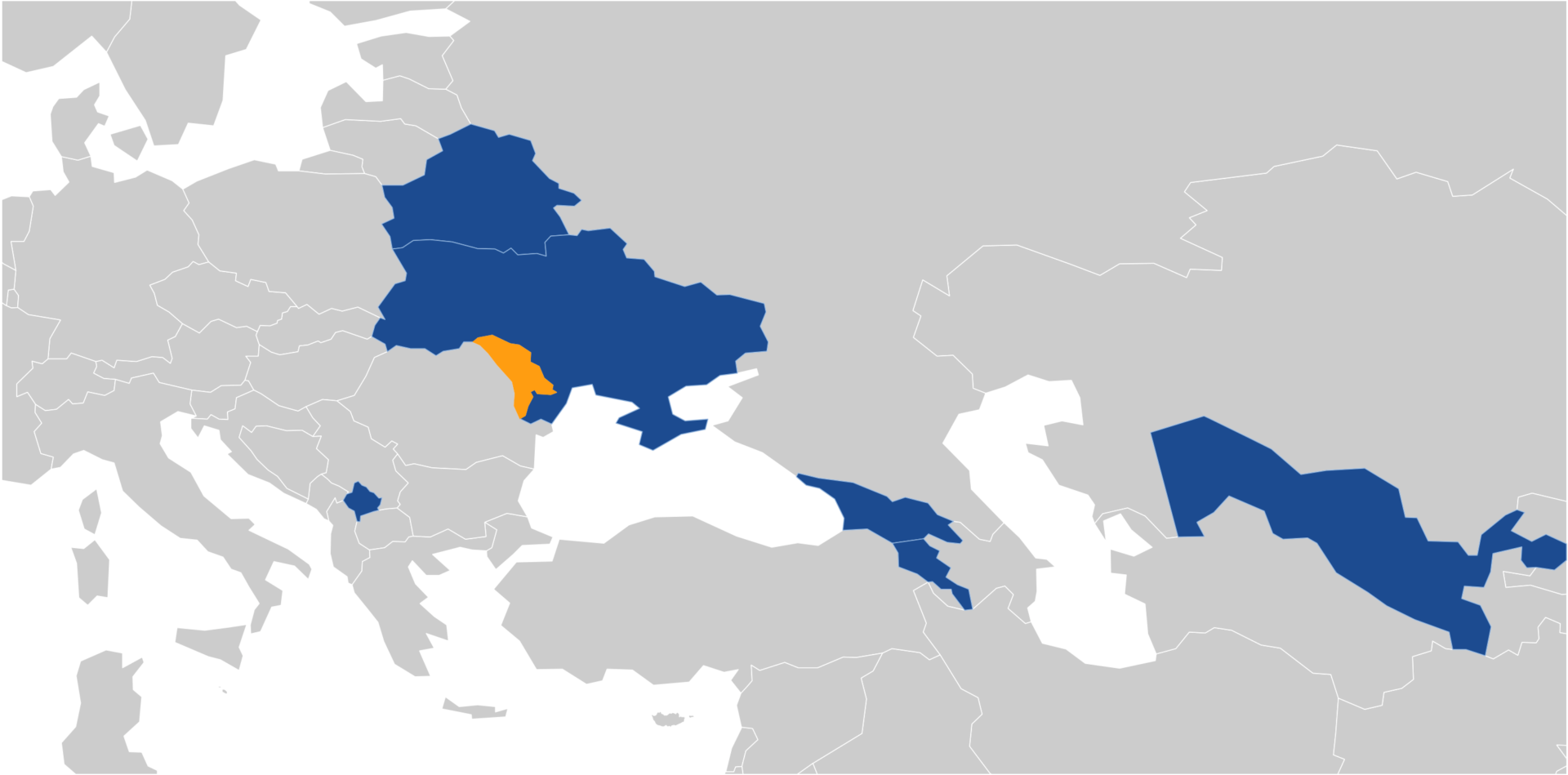

Economic Monitor

The Economic Monitor, published every six months, provides a concise overview of the overall economic situation. Apart from general macroeconomic trends, current economic policy issues are also covered.

The Economic Monitor, published every six months, provides a concise overview of the overall economic situation. Apart from general macroeconomic trends, current economic policy issues are also covered.